Cryptocurrencies have become a significant part of the financial landscape, and as more people invest in digital assets, understanding the tax implications becomes crucial. Fortunately, there are various crypto tax calculators and software solutions available to simplify the process of calculating your tax liabilities. Streamline your crypto tax calculations using the Crypto Tax Calculator, while staying updated on the latest industry trends with a trusted crypto PR agency.

In this comprehensive guide, we will explore the benefits of using a crypto tax calculator, key considerations when choosing one, and provide a list of the top 5 US crypto tax calculators for 2024.

Benefits of Crypto Tax Calculator

Before we dive into the specifics, let’s understand why using a crypto tax calculator is essential.

Simplifying Complex Tax Calculations

Calculating your cryptocurrency taxes manually can be a daunting task. Crypto tax calculators automate this process, saving you time and effort. They import your transaction data, apply the relevant tax rules, and generate accurate reports.

Accurate Tax Reporting

Tax authorities are increasingly scrutinizing cryptocurrency transactions. Using a crypto tax calculator ensures that your tax reports are accurate, reducing the risk of audits, fines, or penalties.

Maximizing Tax Savings

Crypto tax calculators identify potential deductions and credits, helping you minimize your tax liability legally. By optimizing your tax strategy, you can keep more of your crypto gains.

Easy Portfolio Management

Many crypto tax calculators provide portfolio tracking features. This enables you to monitor your investments, analyze performance, and make informed decisions.

Time-Efficient

Using a crypto tax calculator significantly reduces the time and stress involved in tax reporting. You can focus on your investments while the software handles your tax obligations.

Key Considerations When Choosing a Crypto Tax Calculator

Now that we’ve covered the benefits, here are some essential factors to consider when selecting the right crypto tax calculator for your needs.

1. Accuracy

Ensure the calculator accurately calculates your tax liabilities based on the latest tax laws and regulations. Look for one that supports multiple cryptocurrencies and offers real-time data updates.

2. Security

Since you’ll be handling sensitive financial data, prioritize the security features of the calculator. Look for encryption, two-factor authentication, and secure data storage.

3. User-Friendly Interface

Choose a crypto tax calculator with an intuitive and user-friendly interface. This makes it easier to import data, generate reports, and understand your tax situation.

4. Cost

Consider the pricing structure of the calculator. Some offer free plans with limited features, while others charge a one-time fee or a subscription. Find one that aligns with your budget and needs.

5. Customer Support

Check if the provider offers reliable customer support. It’s essential to have access to assistance in case you encounter any issues or have questions about the software.

List of Top 5 US Crypto Tax Calculators in 2024

Cryptocurrency tax calculators are powerful tools that help individuals and businesses in the United States accurately compute their crypto tax obligations. In 2024, several reputable options are available to choose from. Here’s a detailed look at the top 5 US crypto tax calculators, along with their key features and pricing structures

1. Koinly

Koinly is a feature-rich crypto tax calculator designed for US users. It stands out with real-time transaction import capabilities, supporting a vast array of over 6,000 cryptocurrencies.

Koinly also offers tax optimization tools and loss harvesting features, making it ideal for individuals looking to minimize tax liabilities. Its user-friendly interface simplifies the tax reporting process, while comprehensive tax reports help users stay compliant with the IRS. Koinly provides a free plan with limited features, along with premium plans starting at $49 per year, making it a versatile option for crypto tax management.

Features:

- Real-time transaction import.

- Supports over 6,000 cryptocurrencies.

- Tax optimization and loss harvesting.

- Comprehensive tax reports.

- User-friendly interface.

Pricing: Koinly offers a free plan with limited features. Premium plans start at $49 per year.

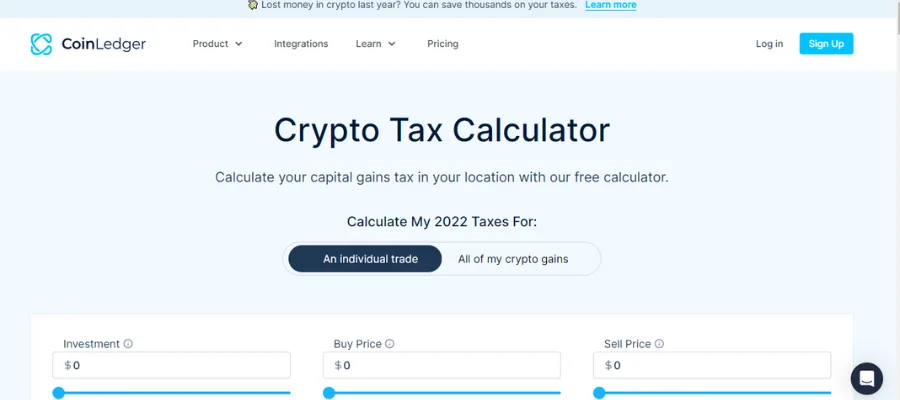

2. Coinledger

Coinledger is a user-friendly crypto tax calculator designed for US taxpayers in 2024. With automatic transaction import and real-time tax calculations, it simplifies tax reporting. Coinledger offers capital gains and loss reports for in-depth insights. Secure data encryption ensures your financial data remains safe.

The software is particularly suitable for those looking for a straightforward tax reporting experience. Coinledger’s pricing includes a free plan with basic features and premium plans starting at just $29 per year, making it an affordable choice for individuals and small businesses.

Features:

- Automatic transaction import.

- Real-time tax calculations.

- Capital gains and loss reports.

- Tax optimization tools.

- Secure data encryption.

Pricing: Coinledger offers a free plan with basic features. Premium plans start at $29 per year.

3. CryptoTaxCalculator

CryptoTaxCalculator is a versatile tax tool suitable for US users managing various cryptocurrencies. It supports a wide range of digital assets and provides automated data import. This software offers detailed capital gains and income tax reports, which are crucial for accurate tax compliance. An audit trail feature enhances record-keeping.

CryptoTaxCalculator offers a mobile app for on-the-go tracking. A free plan accommodates up to 50 transactions, and premium plans start at $79 per year. This makes CryptoTaxCalculator a good choice for those with diverse cryptocurrency portfolios who want robust tax management and tracking capabilities.

Features:

- Supports a wide range of cryptocurrencies.

- Automated data import.

- Capital gains and income tax reports.

- Audit trail for record-keeping.

- Mobile app for on-the-go tracking.

Pricing: CryptoTaxCalculator offers a free plan for up to 50 transactions. Premium plans start at $79 per year.

4. ClearTax

ClearTax simplifies crypto tax calculation for US users in 2024 with a straightforward approach. Users can easily import their transaction data and the software provides real-time tax estimates. Integration with tax filing services streamlines the process, ensuring accurate and efficient tax reporting.

ClearTax’s user-friendly interface makes it suitable for those who are new to crypto tax management. A free plan with basic features is available, and premium plans start at just $39 per year, making it an affordable option for those who want a simple and cost-effective tax calculation solution.

Features:

- Simple transaction import.

- Capital gains and income tax calculation.

- Real-time tax estimates.

- Integration with tax filing services.

- Easy-to-understand reporting.

Pricing: ClearTax offers a free plan with basic features. Premium plans start at $39 per year.

5. CoinTracker

CoinTracker is a comprehensive crypto tax calculator designed for US taxpayers seeking to optimize tax management and portfolio tracking. The software provides automatic transaction syncing and tax loss harvesting tools, helping users maximize tax savings. With support for multiple exchanges and real-time profit and loss tracking, CoinTracker offers a holistic approach to managing crypto assets.

Additionally, its mobile app facilitates portfolio management on the go. CoinTracker’s free plan includes basic features, and premium plans start at $49 per year, making it a well-rounded choice for individuals and businesses looking for comprehensive crypto tax solutions.

Features:

- Automatic transaction sync.

- Tax loss harvesting tools.

- Multi-exchange support.

- Real-time profit and loss tracking.

- Mobile app for portfolio management.

Pricing: CoinTracker offers a free plan with limited features. Premium plans start at $49 per year.

How to Use a Crypto Tax Calculator

Now that you have chosen a crypto tax calculator, let’s discuss how to use it effectively.

1. Gather Your Transaction Data

Collect all your cryptocurrency transaction data, including buy and sell orders, transfers, and any income from staking, mining, or interest. Ensure that you have accurate records of dates, amounts, and transaction details.

2. Import Data to the Calculator

Most crypto tax calculators allow you to import data from various exchanges and wallets. Follow the instructions provided by your chosen calculator to import your transaction history.

3. Verify and Review Data

After importing your data, review it for accuracy. Ensure that all transactions are correctly categorized and that there are no duplicates or missing entries.

4. Generate Tax Reports

Use the calculator to generate tax reports, including capital gains, income, and transaction history. These reports will help you understand your tax liability and ensure compliance with IRS requirements.

5. Optimize Your Tax Strategy

Take advantage of any tax optimization features offered by the calculator. Look for deductions, credits, and strategies to minimize your tax liability while staying within legal boundaries.

6. Keep Records

Maintain copies of your tax reports, transaction data, and any supporting documents. This documentation is essential in case of an audit or to clarify any tax-related questions.

7. File Your Taxes

Based on the reports generated by the calculator, file your cryptocurrency taxes with the IRS or your state tax authority. Ensure you meet all filing deadlines and obligations.

Conclusion

As the cryptocurrency market continues to grow and evolve, staying compliant with tax regulations is of utmost importance. Crypto tax calculators provide a valuable tool to simplify the often complex process of calculating and reporting cryptocurrency taxes. They offer accuracy, convenience, and potential tax savings, making them a worthwhile investment for any crypto investor.

With the top 5 US crypto tax calculators mentioned in this guide, you have a range of options to choose from, each with its unique features and pricing. Remember to consider your specific needs and budget when making your selection.

Using a crypto tax calculator not only eases the tax reporting process but also ensures that you are on the right side of the law. As the crypto space continues to evolve, it’s essential to stay informed and use the tools available to meet your tax obligations and maximize your crypto investment returns.